What do Trump’s 104% tariffs on China mean and who will be affected?

As Trump slaps 104% tariffs on China, Alicja Hagopian and Millie Cooke look at what industries will be hardest hit.

President Donald Trump has escalated his trade war with China, confirming a staggering 104 per cent tariff on goods imported to the US.

The move will hit US consumers hard, with Chinese imports spread across major industries and supply chains - and Apple’s iPhone in the firing line.

The sky-high tariffs came after China hit back with retaliatory measures of their own in what has become a tit-for-tat levies exchange between the two countries.

“If the US insists on having its way, China will fight to the end,” the Chinese commerce ministry has warned, and on Wednesday announced an extra 84 per cent tariffs on the US.

What Chinese goods will be affected?

Of all the countries hit with tariffs, Americans will likely feel the impact of China’s most – and soon.

Meanwhile, as the world’s largest exporter, China sells products to nearly every country. This adds a layer of economic protection against Trump’s tariffs, since the US makes up just 14 per cent of its goods exports.

The 104 per cent total tariff on imported Chinese goods is the highest of any country. And more importantly, American consumers are highly reliant these goods, through many parts of the supply chain.

Unsurprisingly, electronics and machinery are the top goods imported to the US from China, at $208bn in 2023 alone.

These products span all elements of Americans’ lives; from computers to domestic appliances, and electric batteries.

Smartphones are the biggest single export (9 per cent of the total) - and not just Chinese brands such as Huawei, but also American tech leaders including Samsung and Apple which manufacture in China.

On a wider scale, drugs and medicines will likely face price shocks as pharmaceutical companies import billions in ingredients from China each year.

This expense will ultimately fall to patients, warns Dr Michael Aziz, a board-certified internist and regenerative medicine specialist.

"The effect of tariffs on prices of these drugs will be mostly be absorbed by patients, retail pharmacies versus insurance companies,” said Dr Aziz.

“I believe that the rapid application of those tariffs leaves doctors and patients totally unprepared. Many will skip their meds if they can’t afford those generic drugs."

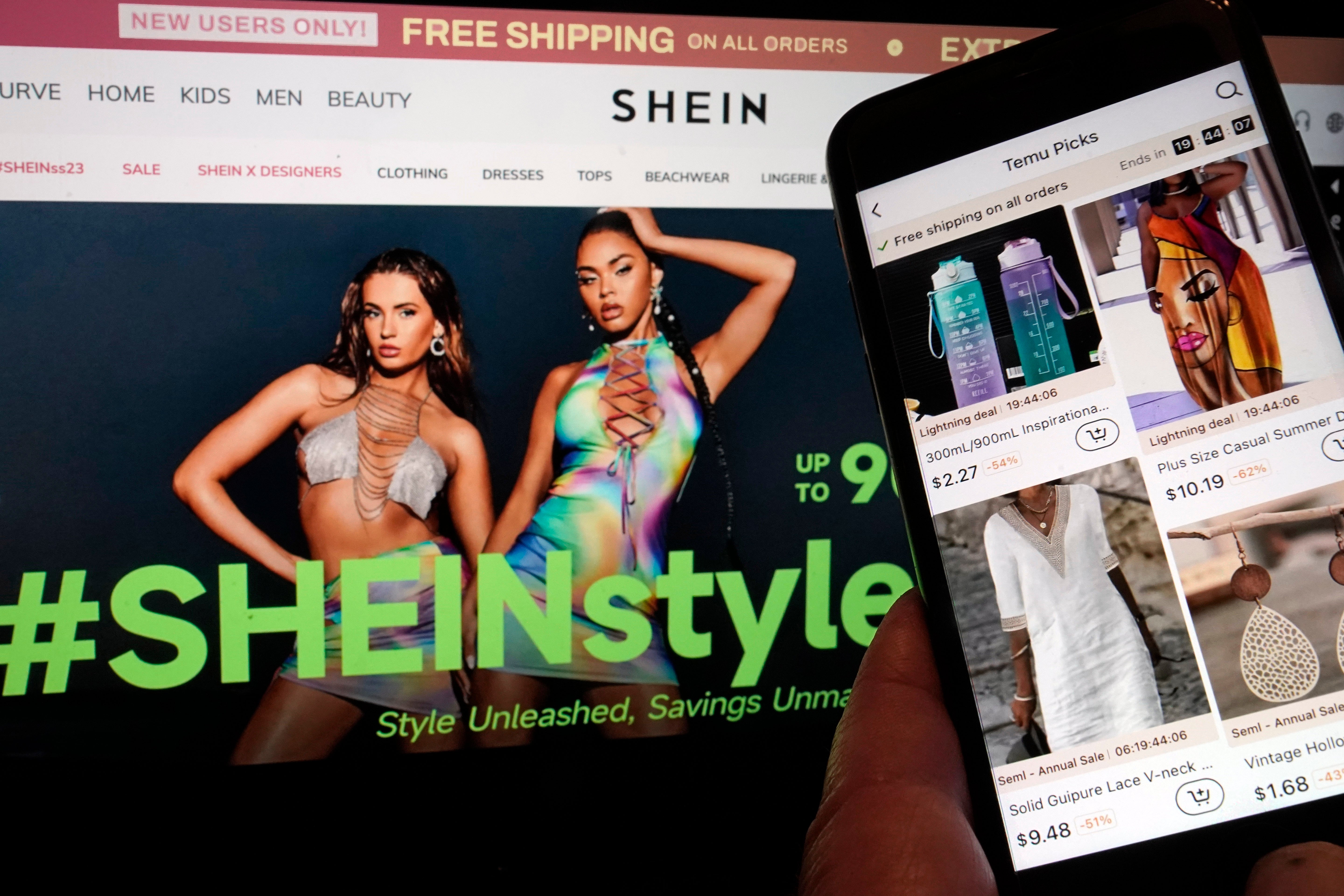

Textile imports worth $36bn will also impact regular consumers; particularly since more and more clothing brands import from China, such as Nike and H&M.

The US is also ending an exemption that allowed low-value products to avoid tariffs.

This means that cheap, American-favourite clothing and homeware brands such as Shein and Temu may face tariffs for the first time – and be forced to increase their prices.

The US-China trade relationship

Previously, retaliatory tariffs from China only covered specific industries such as fuel and agricultural products. Now, all US exports to China will be hit.

The US imports far more from China than it exports. In 2024, goods exported to China were worth $143.5bn, according to the US Trade Representative office.

Meanwhile, the US bought three times as many goods ($438.9bn) in the same period.

This makes the trade deficit $295bn in 2024 - a 5.8 per cent increase from the previous year; and a prime target for President Trump.

This means that the US will be less affected by retaliatory tariffs, Dr Xin Sun, a senior lecturer in Chinese and East Asian business at KCL, told The Independent.

"Given the imbalance in trade between China and US, the damage caused by China's retaliation to US is due to be smaller than the impact of US tariff on China, which is not only the highest among all countries but also affects a wider range of sectors.”

In addition, the economic ties between China and the US have already been shrinking, and the US-China trade relationship accounts for less than five per cent of global goods trade.

"There's been a significant unwinding in the economic ties between these countries since the middle of part of the last decade,” explains Simon Evenett, Professor of Geopolitics and Strategy at the International Institute for Management Development.

“The disengagement has been well underway. What we're seeing now is the next chapter in the process of decoupling between these geopolitical rivals," he said.

Retaliatory tariffs on US industries

According to 2023 data from the Observatory of Economic Complexity (OEC), around half of all goods exported to China are concentrated within five key categories.

The top goods exports are fuel products, including crude and petroleum oil, propane, and liquefied natural gas, which were worth $23.6bn in 2023 (the latest available data).

While the US is a big buyer of machinery and electronics from China, it is also reliant on China buying its own technology.

China bought $17bn in machinery and parts from the US in 2023, and $12bn in electronics.

The top products most affected by reciprocal tariffs, are integrated circuits and gas turbines.

While Mr Trump was quick to slap tariffs on foreign-made cars and parts, the US also exports $7.5bn in cars to China, which will now be impacted by its reciprocal 84 per cent tariffs.

Other areas of the transport manufacturing sector, namely aviation, have billions of dollars in goods at risk.

Dr Mary Lovely, Senior Fellow at Peterson Institute for International Economics, said major American brands will suffer from the changes.

“We had settled into a new routine, and now that status quo was just completely upended by the tariffs from both sides,” she told The Independent.

“I think long term, this actually reduces the prospects for companies like Boeing. This is going to impact companies like Apple and Caterpillar exports - companies which also export to [China].”

The US pharmaceutical industry is also a major exporter to China, selling over $7.5bn in vaccines and packaged medicine in 2023, alongside $3.3bn in medical instruments.

US farmers set to suffer most

Most of all, Dr Lovely believes that the US agricultural sector will be worst hit by China’s tariffs.

China is a top buyer of its vegetable products ($20bn) — not least US soy ($15bn), buying over half of all US exports.

Billions in American meat and animal products will also be affected, while Mr Trump attempts to force the UK to buy chlorinated chicken in exchange for tax relief.

These tariffs on farmers could have a significant impact on Trump's core political base, Dr Sun warned, pointing out that agriculture is a key export from the US to China.

Dr Sun said: "Since agriculture constitutes a lion share of US export to China, China's retaliation has a bigger impact on some of Trump's core political base. By targeting this population, China hopes to cause political pains for Trump and force him to back down somewhat.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments