Stay up to date with notifications from The?Independent

Notifications can be managed in browser preferences.

Trump on trial

trump on trial

Could a stealth juror derail Trump’s trial?

trump on trial

Two seated jurors struck from Trump hush money trial

Top stories

climate crisis

Does anyone care about climate this election? These voters say yes

The majority of Americans have experienced extreme weather events in the last five years — but the climate crisis still lags behind inflation, healthcare, immigration and jobs when it comes to voter priorities. Louise Boyle reports

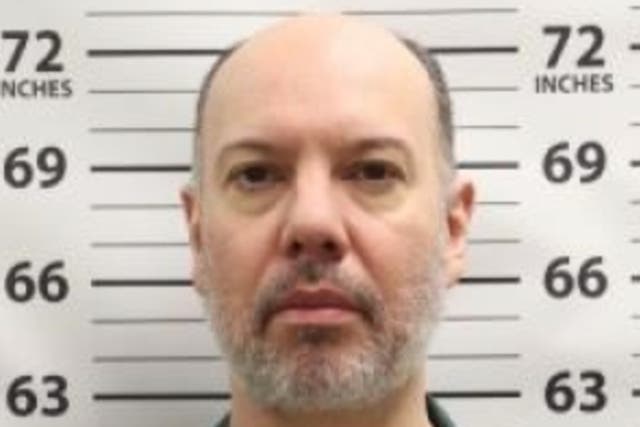

Livechad daybell

Chad Daybell trial: Cult dad’s search history revealed to jurors

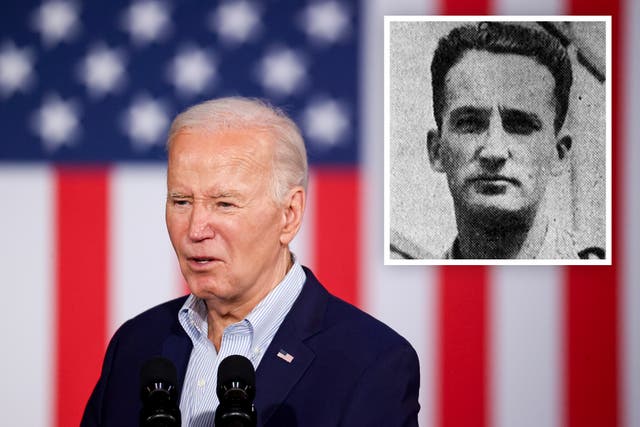

rudy giuliani

Giuliani’s bankruptcy could cost him his apartment, his jewellery and, perhaps worse, his Joe DiMaggio shirt

From multimillion-dollar properties to luxury watches (and a replica signed Joe DiMaggio shirt), the former New York mayor and Trump attorney may have to part with some cherished items to pay his creditors, writes Kelly Rissman